(Courtesy of the “Green Valley News”)

Every day, about four or five times a day, Doug Kenyon’s phone lights up with news of another scam.

“Let’s see what today’s is – oh, another debit card fraud,” he said, scrolling through the notification. Ten minutes later, he gets another – this time about car warranty robocalls.

As a member of the Green Valley Sheriff’s Auxiliary Volunteers for more than eight years, and now commander of the SAV, Kenyon has seen waves of scam activity flood the Green Valley area.

“It used to be primarily phone scams in the beginning,” he said.

“And then the scams just continued. From the IRS to bank frauds to credit cards and computers getting hacked – it’s just nonstop. I keep thinking it’s going to go away, but it does not go away,” he said.

While scams of one type of another have been around forever, increasingly novel and nuanced internet scams – like robocalls requesting ransoms for your grandchildren or emails about bogus COVID vaccine surveys – have made it even more difficult to avoid being taken advantage of, especially for older adults.

And nationwide, as reports of identity theft are on the rise, awareness and fraud prevention efforts at the local level – from financial institutions to volunteer organizations like the Green Valley SAV’s Scam Squad – are increasingly needed to combat the epidemic.

By the numbers

Over 2.2 million cases of fraud were reported in the U.S. in 2020, according to data compiled in the Federal Trade Commission’s 2020 Consumer Sentinel Network. Over a third of those cases also reported a financial loss, with an estimated $3.3 billion in fraud losses last year, up from $1.8 billion in 2019.

Though only 18 percent of those age 80 or older said fraud deprived them of assets in 2020, data from the FTC showed that when people age 70 and older had a loss, their median was much higher. Last year, fraud victims age 80 or older suffered the largest median losses of any age group – about $1,300.

The pandemic has also proved to be fertile ground for identity thieves, who were busier than ever in 2020. The FTC dataset showed the number of identity theft reports have more than tripled since 2018, growing to nearly 1.4 million in 2020.

The report also showed an astonishing 1,650 percent increase in government documents and benefit fraud from 2019 to 2020. This specific fraud accounted for 39 percent of all identity theft reports in Arizona, with nearly 11,000 reported cases last year.

Many of these victims claimed their information was used to apply for or receive government benefits, like unemployment compensation, a trend that likely stems from the trillions of federal dollars earmarked for COVID-19 relief.

Local branches

When he moved from Tucson to manage the Commerce Bank of Arizona in Green Valley, Robert Castelo said he saw a notable increase in the number of scams he’s witnessed, especially in the last year.

“I don’t know if it’s due to the pandemic or the world we’re living in right now, but working in a bank you do see people getting scammed a lot,” he said.

In the Green Valley area, branch managers have increasingly seen customers falling for scams involving fake phone calls from the IRS, fake cashiers checks that are then used to purchase gift cards, and robocalls about forfeiting their Social Security money, among others.

“Because of the pandemic, a lot of elderly people were pushed to use online services who might not normally, so we’ve seen a lot of people getting scammed through phones and computers, maybe because they’re not used to it,” Castelo said.

With any transaction, Castelo said bank employees conduct due diligence researching where the money is headed, but are increasingly trained in how to talk to customers they suspect are being scammed.

If a customer who does not regularly withdraw large sums of cash is attempting to do so, a teller may open up a conversation about what they plan on using the money for – a vacation, a shopping spree, possibly a new car.

“Every situation is different, but we try to keep it natural and just get them to open up a little bit, and try to talk it through,” Castelo said.

“We do get a lot of customers saying it’s none of our business, and that it is their money – and by all means, it is. But we remind them we are here to take care of it, and always just trying to help,” he said.

Colleen Ward, branch manager for Washington Federal Bank of Green Valley said having close relationships with clients makes it easier to detect unusual banking activity.

“As bankers, we are trained to look for signs of fraud in every transaction. When we ask why the client is pulling out such a large dollar amount, we are not trying to be invasive of how they handle their finances, we are simply making sure the client’s money is safe,” Ward said.

Castelo said interventions at his own branch have saved multiple clients from huge losses – they’ve talked customers out of withdrawing huge sums of cash, and even refused to wire money for one woman who was victimized by a phone scammer.

But sometimes, even these direct interventions are not enough. When Commerce Bank of Arizona refused to wire the money for the woman, Castelo said she went to a different bank to complete the wire transaction. Only later did she realize her mistake and reported the scam to the Pima County Sheriff’s Department.

“That client admitted she did what she did because was lonely and a little embarrassed, and that’s just one thing we can’t help when people get a phone call, and they just want to talk to someone and believe in someone,” Castelo said.

In situations like these, Castelo and Ward said they refer customers to the Green Valley Sheriff’s Auxiliary Volunteers for more resources, tools and steps to take if they fall victim to a scam.

Education, awareness

When Kenyon first joined the Sheriff’s Auxiliary Volunteers in 2013, he remembers being inundated with reports and calls from scam victims. One woman, he recalled, sent a thousand dollars to a Canadian lottery to claim her winning ticket. Another Green Valley resident sent cash in the mail for a boat he bought online. Neither of them received their prizes.

“We just had so many scams…we couldn’t go to all of them. We had so many patrol units actually going out to these scam calls that we weren’t able to do other calls. That’s how many we had,” Kenyon said.

At that point, Kenyon said SAV realized it needed to do more than just be there to receive a call or complaint.

“We needed to do some training and educate the public of what was really going on,” he said.

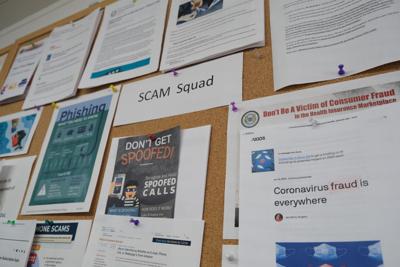

The Scam Squad was born out of this mission to teach the community about scams, and help prevent them from happening.

For the past 10 years, a dedicated team of volunteers spend their shifts researching the latest frauds, or old scams that are resurfacing with new twists, and share them with the community through various outlets, including a weekly email newsletter and a column in the Green Valley News.

In a typical year, the Scam Squad will also give presentations at local HOA meetings and community events on the latest fraud schemes, and what to do if you suspect yourself, or someone you know, may be getting scammed.

Kenyon said this constant communication with the community has likely been the key to the Scam Squad’s success.

“Since I’ve been here, I can see that the number of actual calls, where we’re going out and people are actually falling for the scams, has gotten a lot less. And I attribute that primarily to the education and presentations and our website,” he said.

“We’re getting the word out and getting people aware, so that when they get that phone call, or letter, or even that knock on the door, they’re already thinking it may be a scam.”

John Yedinak, a Scam Squad volunteer, reiterated that the best way you can save yourself from getting scammed is to simply ignore anything that seems suspicious.

“If you don’t recognize the phone number, don’t answer. If you get something on your computer and you don’t know where it came from, delete it. If you don’t know who somebody is, ignore them,” Yedinak said.

“The last thing you want to do is give anybody your information, and once you start talking to them on the phone, these guys are really good at getting into all of that,” he said.