by Alvaro Puig, FTC

Consumer Education Specialist, Division of Consumer and Business Education

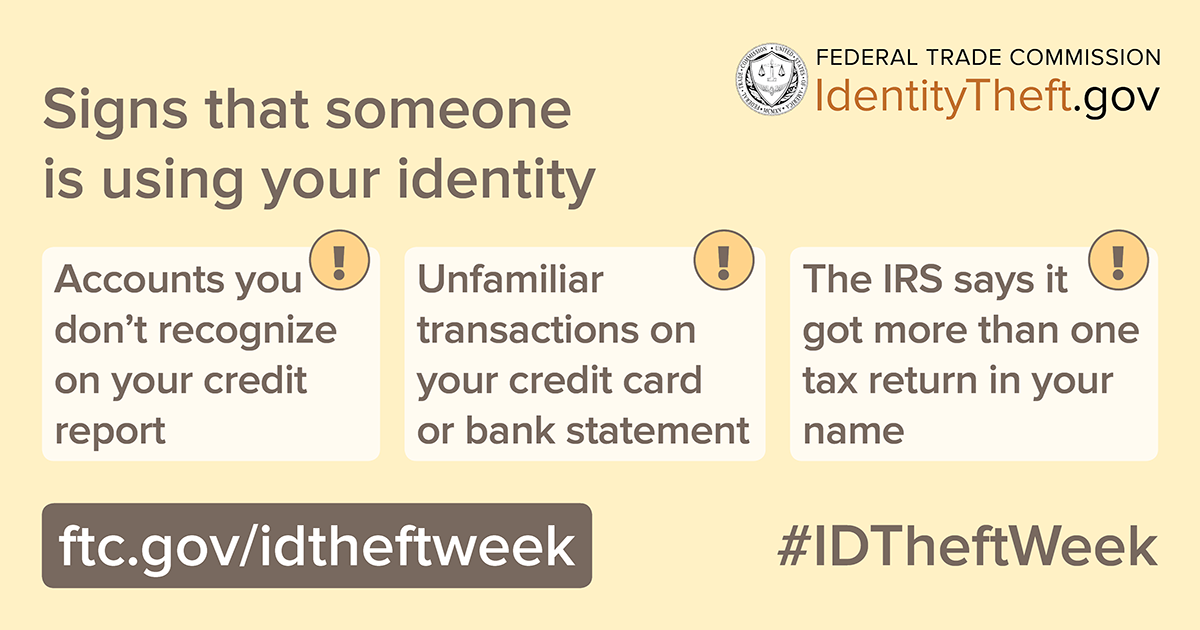

Taking steps to protect your personal information can help you minimize the risks of identity theft. But what if a thief gets your information anyway? Here are some of the ways thieves might use your stolen information and signs you can look out for.

An identity thief could use your information to get credit or service in your name.

- How to spot it: Get your free credit report at AnnualCreditReport.com. Review it for accounts you didn’t open or inquiries you don’t recognize. A new credit card, a personal loan, or a car loan will appear as a new account. A new cell phone plan or utility service — like water, gas, or electric — will show up as an inquiry.

An identity thief could use your credit card or take money out of your bank account.

- How to spot it: Check your credit card or bank statement when you get it. Look for purchases or withdrawals you didn’t make.

- Bonus advice: Sign up to get text or email alerts from your credit card or bank whenever there’s a new transaction. This could help you spot unauthorized or fraudulent activity on your account.

An identity thief could steal your tax refund or use your Social Security number to work.

- How to spot it: A notice from the IRS that there’s more than one tax return filed in your name could be a sign of tax identity theft. So could a notice that you have income from an employer you don’t work for.

An identity thief could use your health insurance to get medical care.

- How to spot it: Review your medical bills and Explanation of Benefits statements for services you didn’t get. They could be a sign of medical identity theft.

An identity thief could use your information to file a claim for unemployment benefits.

- How to spot it: A notice from your state unemployment office or employer about unemployment benefits that you didn’t apply for could be a sign of fraud.